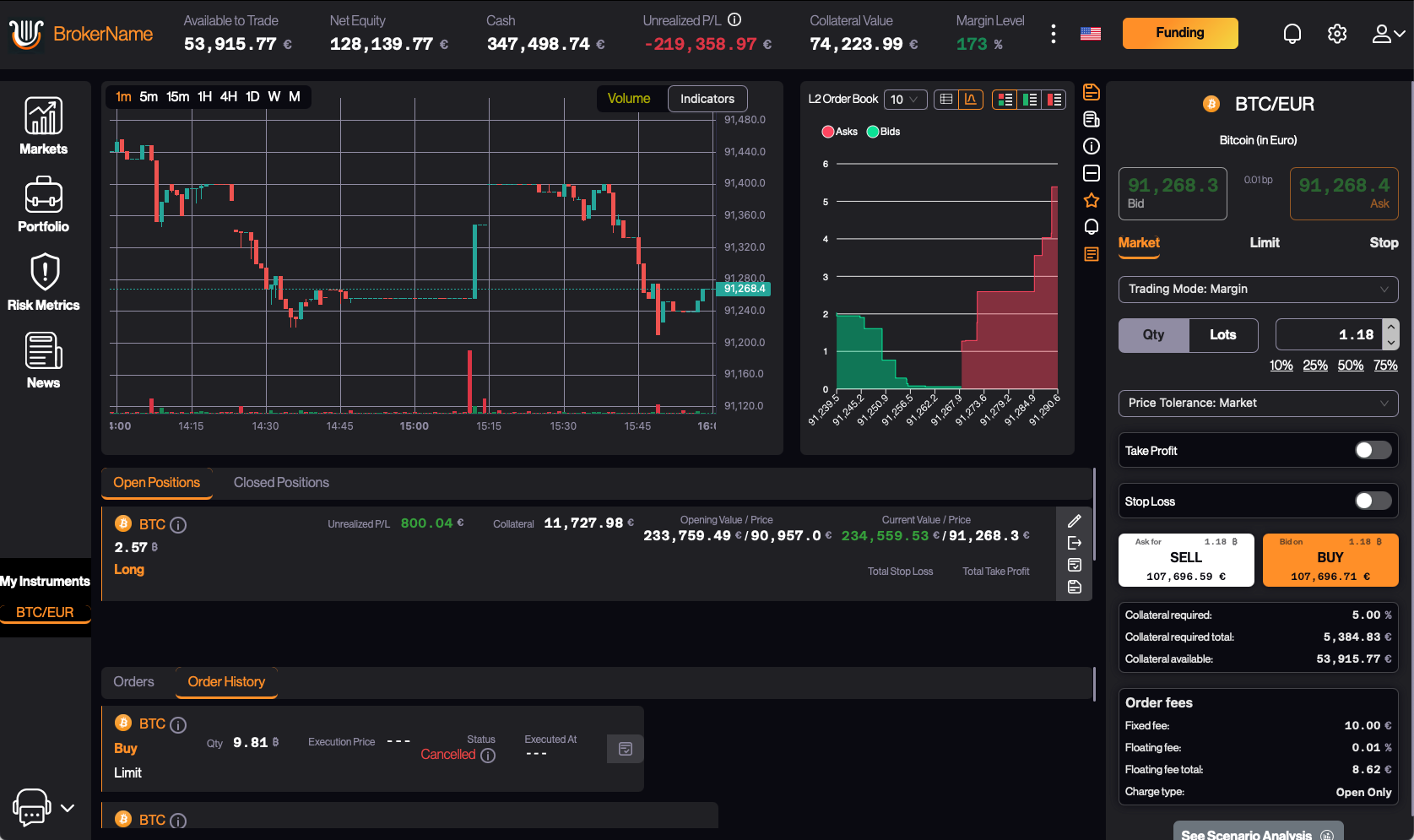

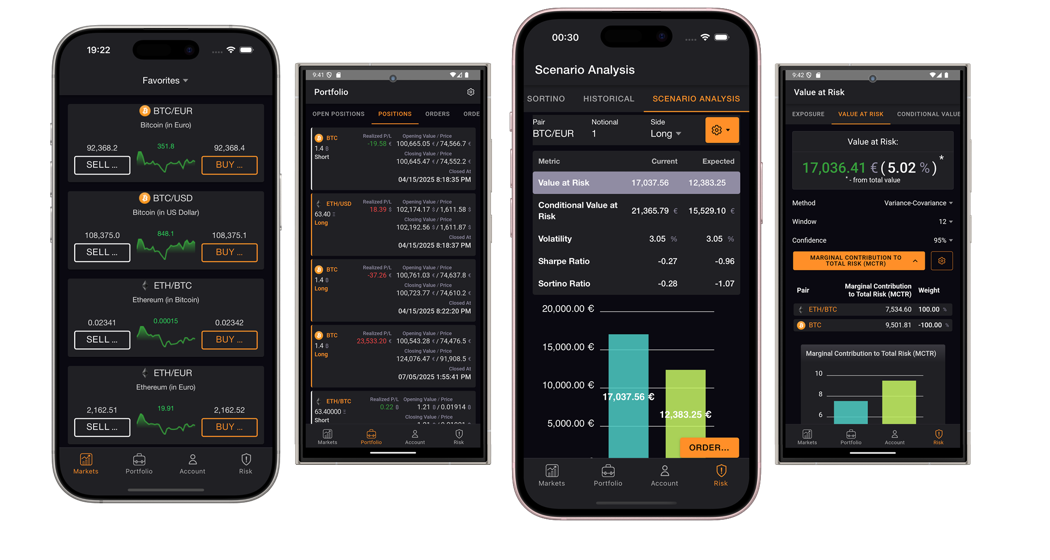

Trading meets intelligence—real-time portfolio control in a responsive, branded workspace.

The trading interface is where execution, risk, and user experience converge. From custom layouts to embedded VaR and margin prompts, every action reflects live portfolio state—drawn from the OMS and checked in real time by the risk engine before execution.

Seamless Multi-Asset Trading

Lyra’s Trading Interface offers a fully customizable and modular trading experience across web, mobile, and desktop platforms. With support for a broad range of asset classes—forex, equities, commodities, crypto, prediction markets and derivatives—your traders can execute sophisticated strategies with real-time data and investment-bank-grade risk tools integrated directly into the trading interface.

Advanced real-time risk metrics and what-if simulations, typically found only in the most advanced institutional platforms—are built directly into the trading interface.

Overview

Trade FX, equities, crypto, commodities, derivatives, predictions and more—in one workspace.

Full broker control over layout, branding, and trading workflows.

Millisecond-level routing and L2 data across all broker-connected venues and LPs.

Monitor exposure, VaR/ES and other metrics; preview changes before sending an order.

Trading Interface Overview

Lyra’s Trading Interface is a responsive, multi‑window workspace that runs natively in any modern web browser and on dedicated mobile apps. It instantly inherits your brokerage’s branding—logos, colors, fonts, and custom widgets—but also enables deep functional customization: from tailored trading workflows and screen layouts to conditional logic in order forms and dynamic exposure prompts, all without touching core code.

Powerful streaming architecture delivers Level‑2 order‑book depth, time‑and‑sales, and tick‑chart updates in under 10 ms. Traders can dock blotters, charts, news, and risk widgets to create personalised layouts that persist across sessions. Full localisation and accessibility support are built‑in.

The interface is deeply integrated with Lyra’s OMS and risk engine: every order ticket exposes margin impact, VaR/ES(CVaR), and buying‑power checks before submission. The UI also supports specialised instruments such as binaries and knock‑outs whenever they are enabled in the underlying OMS configuration. Prediction markets and other non-standard instrument types are also supported when configured through the OMS.

Markets screen

Workspace

Trading Interface Features

Benefits

- Launch faster with a turnkey system offering full-feature parity and tools found only at top-tier brokerages.

- Deliver seamless multi-asset trading with native support for FX, crypto, equities, derivatives and more.

- Boost engagement and safety with high-performance UX, real-time risk controls, and pre-trade checks.

- Custom-fit the UI to your brand and workflows—colors, widgets, flows easily adapted without breaking logic.

- Support institutional and retail traders with advanced order logic, persistent layouts and professional tools.

- Scale confidently via modular architecture, localization, and tight integration with OMS and risk systems.

Sample screenshots

Sample screenshots

Explore other key components of the Lyra platform: