Real-time portfolio and firmwide risk—one engine for brokers and their clients.

Unchecked exposure, misfired hedges, slow margin responses—these failures have ended entire brokerage businesses. Risk isn’t a report; it’s a live system. Lyra's risk engine was built for real-time action, not just after-the-fact awareness.

Real-Time, Enterprise-Grade Control

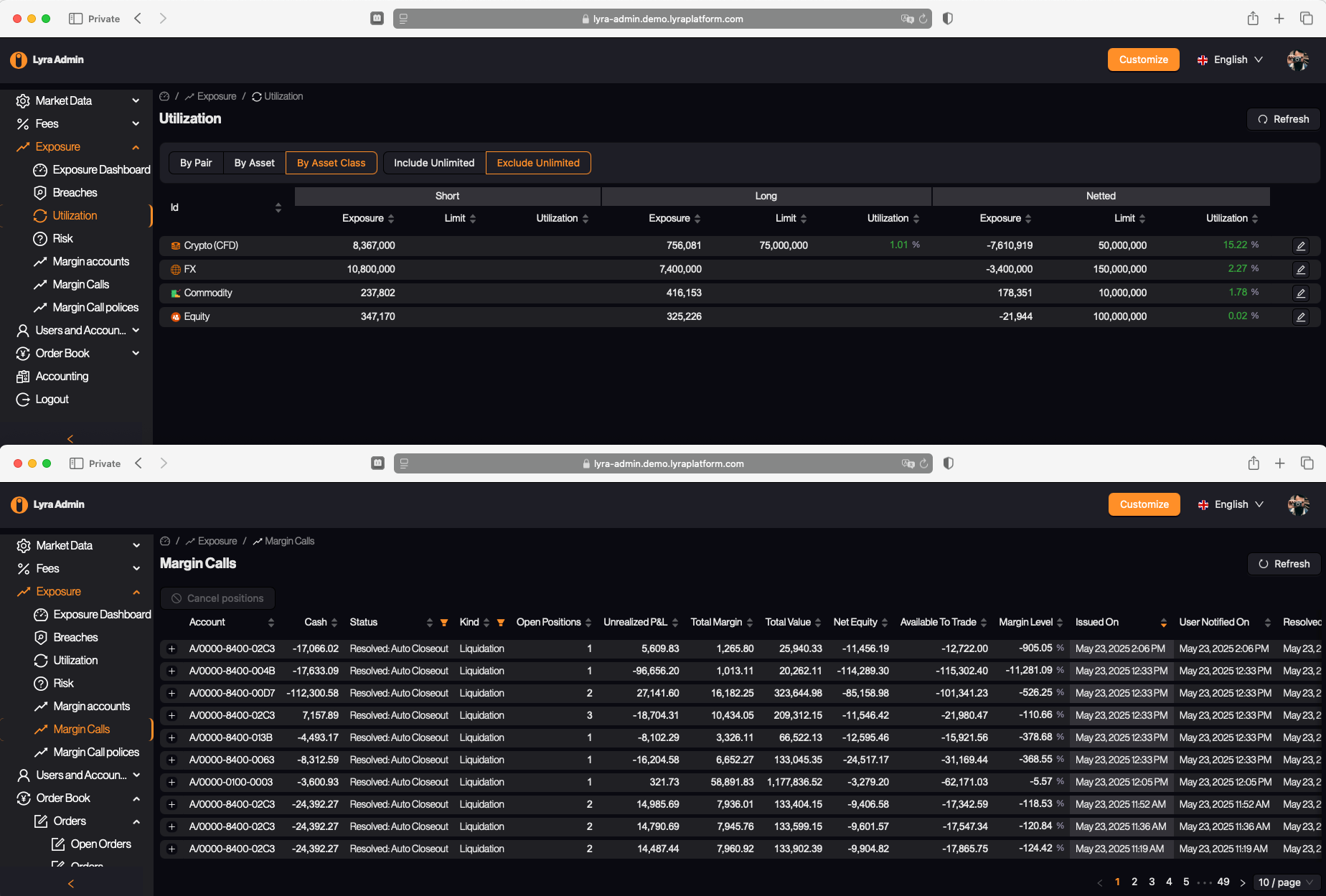

Lyra’s Risk Management stack delivers investment-bank-grade deterministic analytics inside a white-label platform. It covers both client-side portfolio risk and broker firm-wide exposure. Metrics update continuously. When risk or margin thresholds are hit, Lyra can hedge, reroute, or restrict trades in real time. All metrics and enforcement workflows align with Basel III/IV capital adequacy standards, giving brokers confidence their controls meet global regulatory expectations.

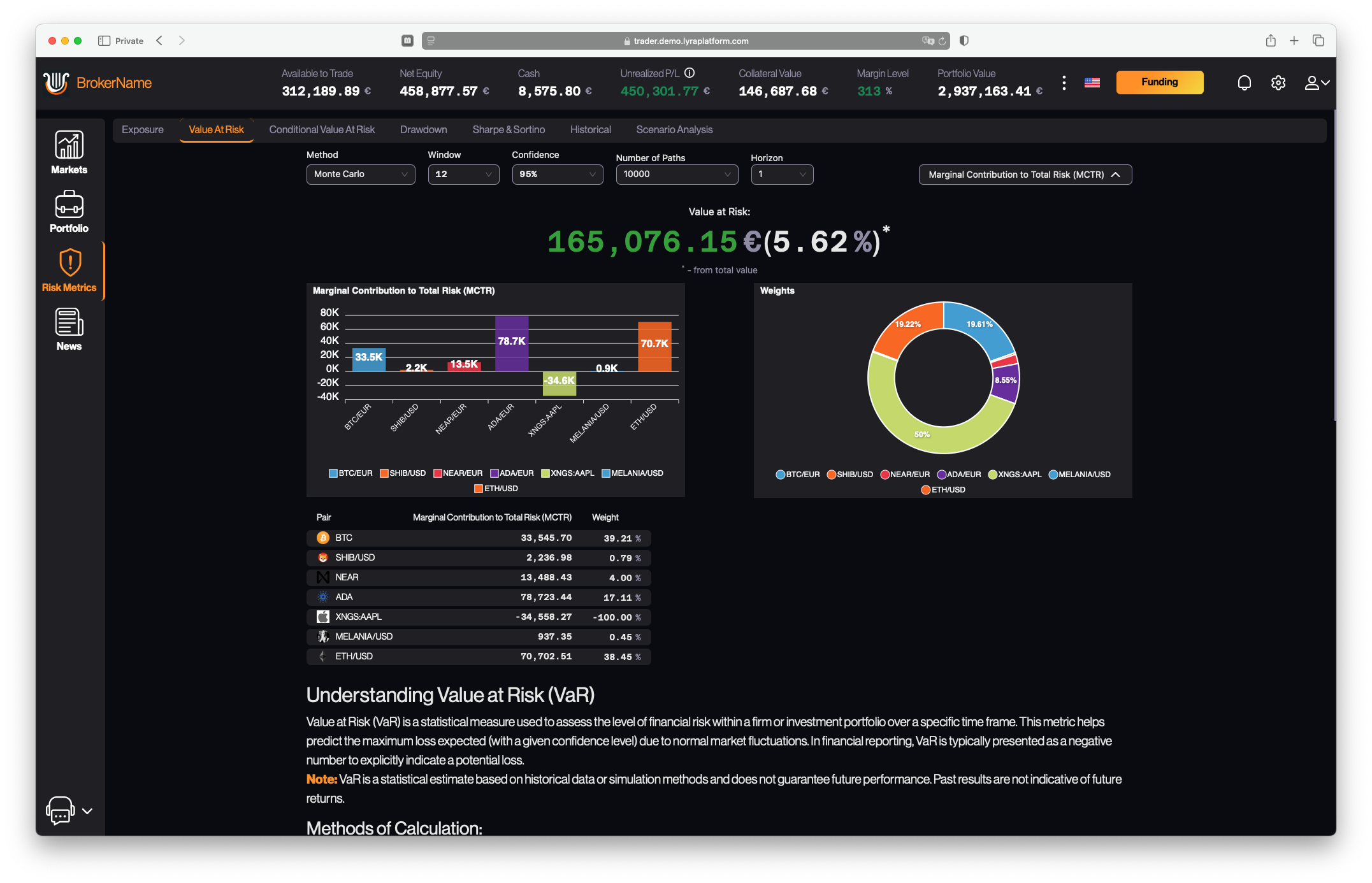

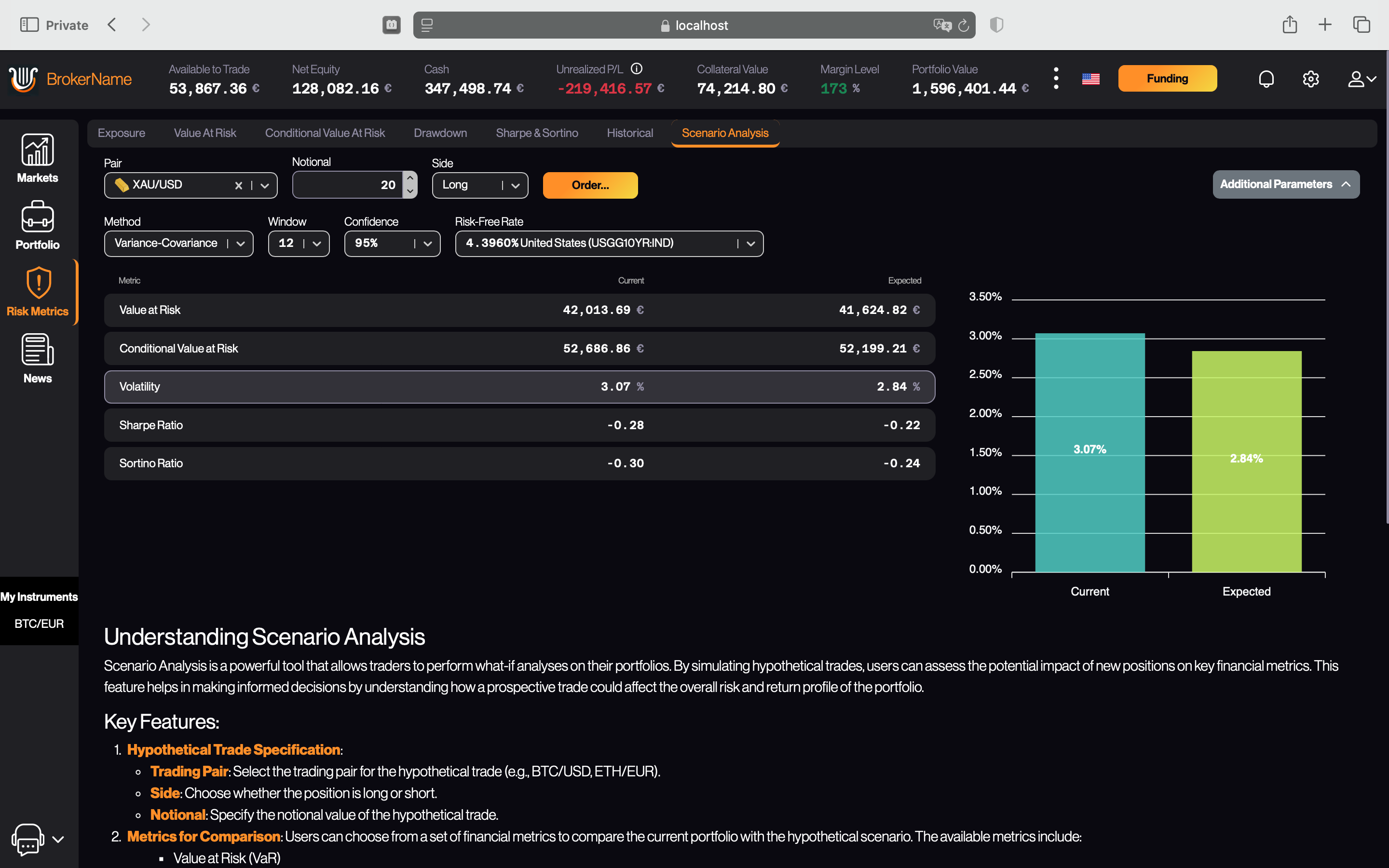

Every risk metric: Value-At-Risk(VaR), Expected Shortfall (ES/CVaR), drawdown, Sharpe/Sortuno, and more. Everything is computed in real time and stored historically. Traders get precise control over risk. Brokers get the tooling needed to manage market-making, agency, or hybrid flows safely.

Overview

Client & Broker Layers: Same risk engine powers both. Traders preview trade impact; brokers act on firm-wide exposure.

Hybrid Execution: Dynamically routes or internalizes trades based on real-time exposure thresholds.

1M-Path Monte Carlo: First white-label platform with institutional-grade VaR/ES simulation capability.

What-If Simulator: Preview portfolio impact of prospective trades or hedge baskets instantly.

Risk Engine Highlights

Lyra’s risk engine performs high-frequency portfolio- and firmwide-level simulations—including Monte Carlo VaR with up to 1 million paths. These run periodically per user portfolio, enabling historical charting and advanced risk profiling. All calculations adhere to Basel III/IV methodologies, ensuring out‑of‑the‑box regulatory compliance.

Exposure-Aware Routing: When firm-wide thresholds (granular by asset class, symbol, or direction) are hit, Lyra can automatically hedge or route new flow externally keeping the broker’s risk within limits without throttling client activity.

Users can chart the full history of risk and performance metrics—including MAE/MFE, ROI, win ratio, and CAGR—at both the portfolio and position level.

Margin workflows are fully customisable, supporting staged notifications, partial liquidations*, NBP enforcement, and jurisdiction-specific rules.

Firmwide Exposure Dashboard

limit utilization and margin calls

Risk Features at a Glance

Trader's VaR with MCTR

Trader's Scenario Analysis

Benefits

- Bring institutional-grade analytics to retail clients—unique in the white-label space.

- First white-label platform with user-configurable Monte Carlo VaR—up to 1 million paths, with historical charting.

- Protect broker capital via real-time, exposure-aware hedging rules.

- Cut operational risk with deterministic, tick-level margin enforcement.

- Boost client retention through transparent risk metrics and what-if tools.

- Satisfy regulators faster with Basel‑aligned metrics, immutable audit trails, and drop-copy* feeds.

iOS

Andrioid

Explore other key components of the Lyra platform: