From retail clicks to FIX flows, Lyra's OMS enforces execution logic with precision and speed.

An OMS isn’t just a pipe—it’s the control plane. Lyra captures, validates, routes, and settles every order with deterministic logic and sub-millisecond latency. Every ticket follows a programmable lifecycle—guided in real time by Lyra’s risk engine to align with exposure limits, margin rules, and regulatory constraints.

Execution, Routing & Control

Lyra’s Order Management System is the real‑time engine that captures, validates, and routes every order while enforcing risk and compliance. It unifies institutional FIX flows, retail UI orders, and algorithmic trades into a single, auditable lifecycle—delivering millisecond execution and constant margin visibility.

Whether you operate as a market‑maker, agency broker, or hybrid model (A/B-Book Execution) the OMS provides granular rule sets for matching, hedging, routing and fee assessment. Advanced features like exposure‑aware auto‑hedging, hierarchical margin schedules, and synthetic instrument support put Tier‑1 capability within reach of mid‑size brokers.

Designed to operate as both agency and principal OMS, Lyra natively supports cash, margin, and hybrid trading across all asset classes (FX, equities, crypto, CFDs, options, futures*, and other derivatives). Retail and institutional orders follow a consistent, programmable execution logic—enforced in real time.

Overview

Manages full order lifecycle—capture, validation, routing, matching, clearing.

Sub‑millisecond routing to LPs, exchanges, or internal books with audit stamps.

Cash, margin and mixed accounts; firmwide exposure metrics affect ticket acceptance and routing.

Can act as a standalone exchange with built-in order matching, clearing, and fee engines for select markets.

OMS Overview

Lyra’s OMS cluster scales horizontally—processing thousands of orders per second while retaining deterministic sequencing and micro‑second timestamping. Margin checks, buying‑power validation, and NBP safeguards are executed before an order is accepted, with re‑checks on every fill or market move.

This unified model ensures deterministic behavior across all order sources and client types.

Routing tables are fully programmable: direct venue mapping, smart order routing, or exposure‑aware hedging can be defined per asset, asset class or client tier. Internal Book matching supports maker/taker fees and partial fills, while exposure limits or auto‑hedger logic can stream residual risk to external LPs in real time.

Comprehensive audit trails ensure every event is reconstructible. Daily settlement workflows tax‑lot assignment are built‑in, allowing to reconcile positions and PnL without auxiliary systems.

The OMS integrates natively with Lyra’s Risk Management and Operations Portal components, and optionally connects to the broker’s own CRM and accounting systems—allowing flexibility in client management, reporting, and downstream reconciliation workflows.

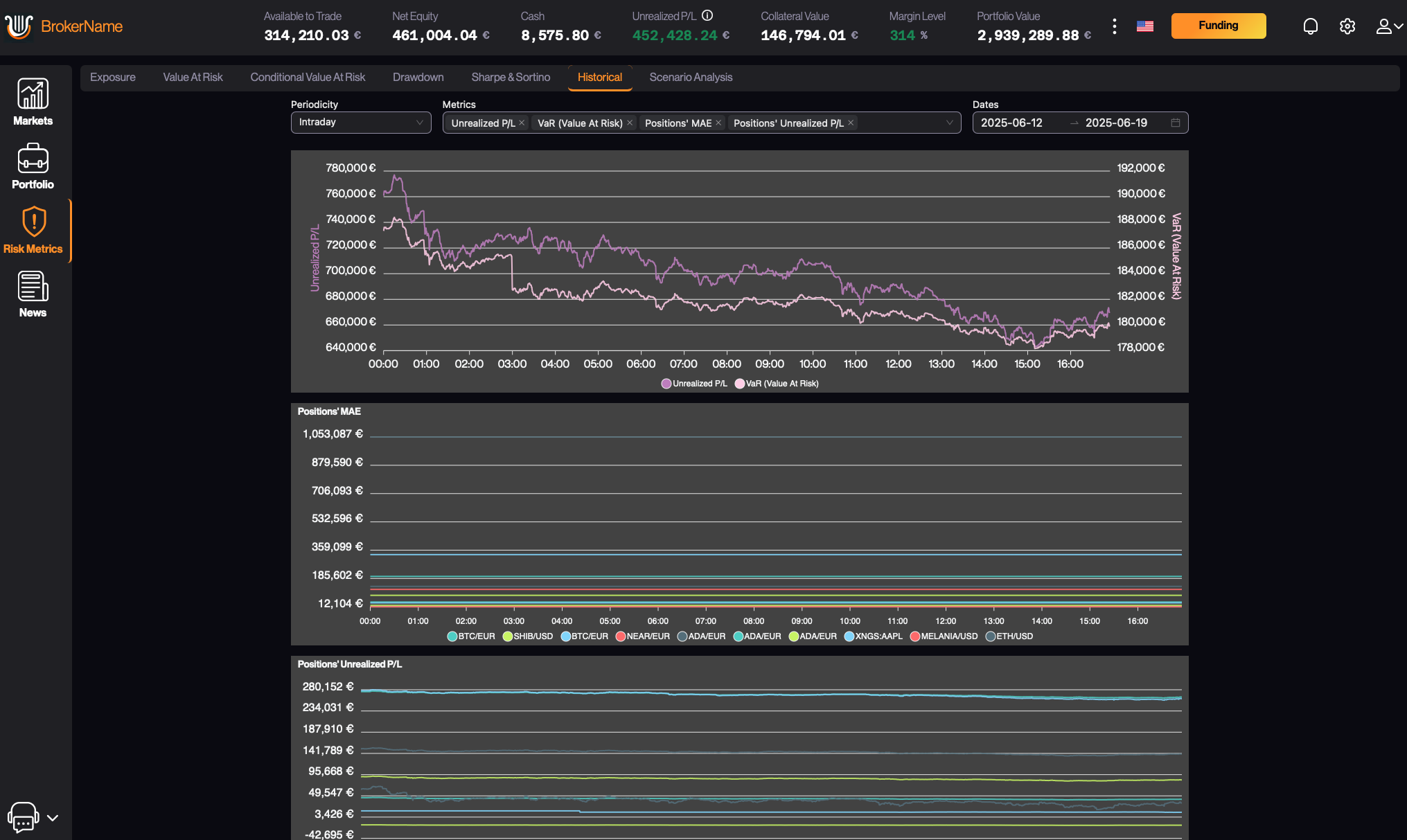

trader portfolio - history

trader portfolio - realtime

OMS Features at a Glance

Benefits

- Institutional-grade execution without enterprise overhead or cost.

- Support agency, market-making, and A/B-book execution with flexible routing.

- Run cash, margin, and hybrid accounts with programmable lifecycle rules.

- Expand product offering with synthetics, internal matching, and exchange-style clearing.

- Reduce operational risk via real-time margin checks and NBP enforcement.

- Scale across venues and jurisdictions with audit trails, drop-copy, and modular deployment.

Explore other key components of the Lyra platform: