Operational risk, exposure, and margin logic—all in one live control interface.

The Lyra Operations Portal is more than a configuration interface—it’s a real-time control surface for managing exposure, margin, asset parameters, fees, and compliance triggers. From real-time tick-level overrides to firmwide risk coordination, everything flows into one pane of control.

Broker Control, Real-Time and Granular

The Lyra Operations Portal unifies live order book monitoring, exposure limits and breach management, asset settings, fee control, and margin workflows in one high-performance interface. All changes are reflected instantly in the OMS and trading UI. No deployments. No delays. Just control.

Overview

Visualize exposure across asset classes, pairs, or accounts. Monitor and manage limit utilization and breaches.

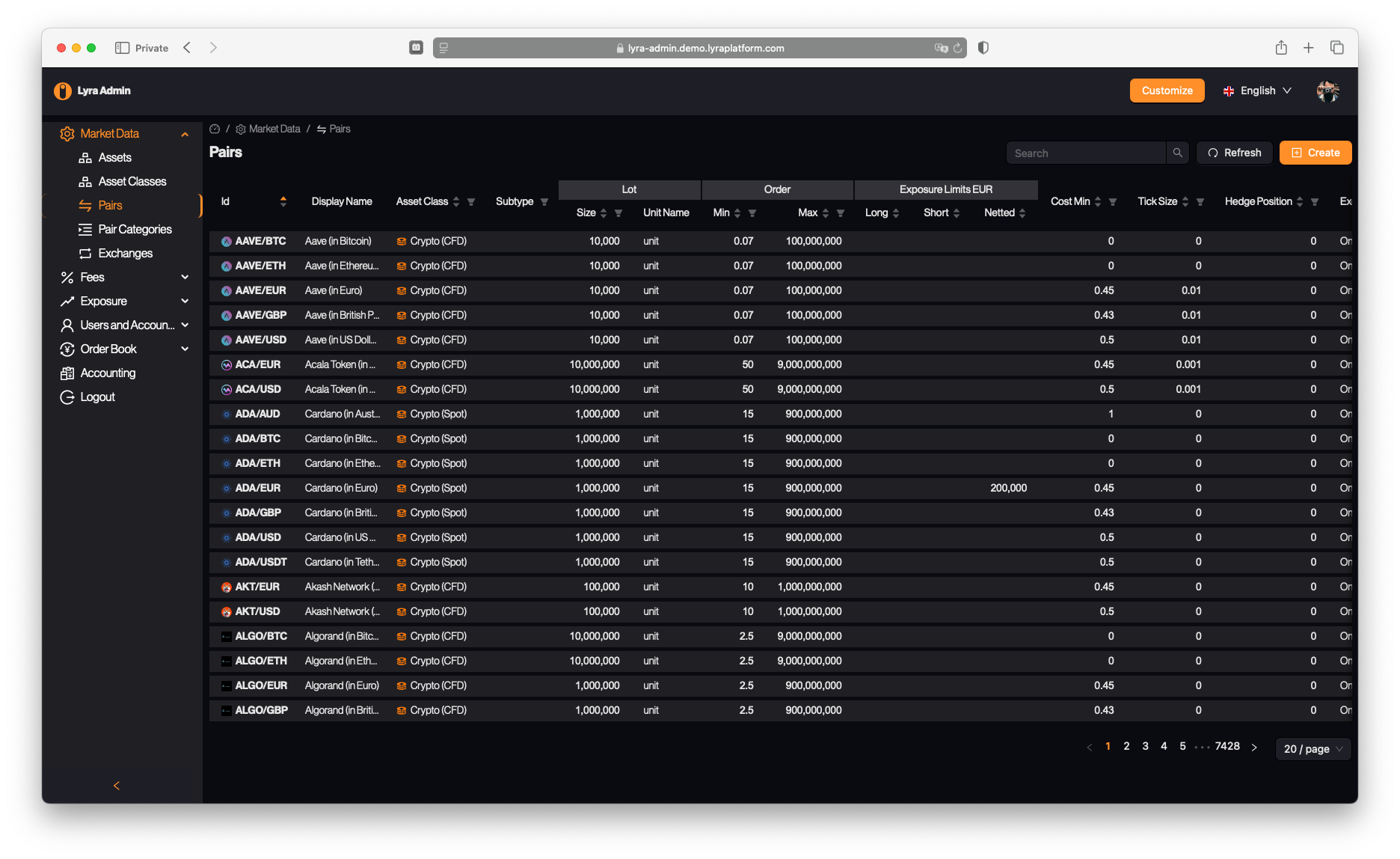

Edit instruments, costs, lot sizes, spread rules and more—per exchange, asset class, or client group.

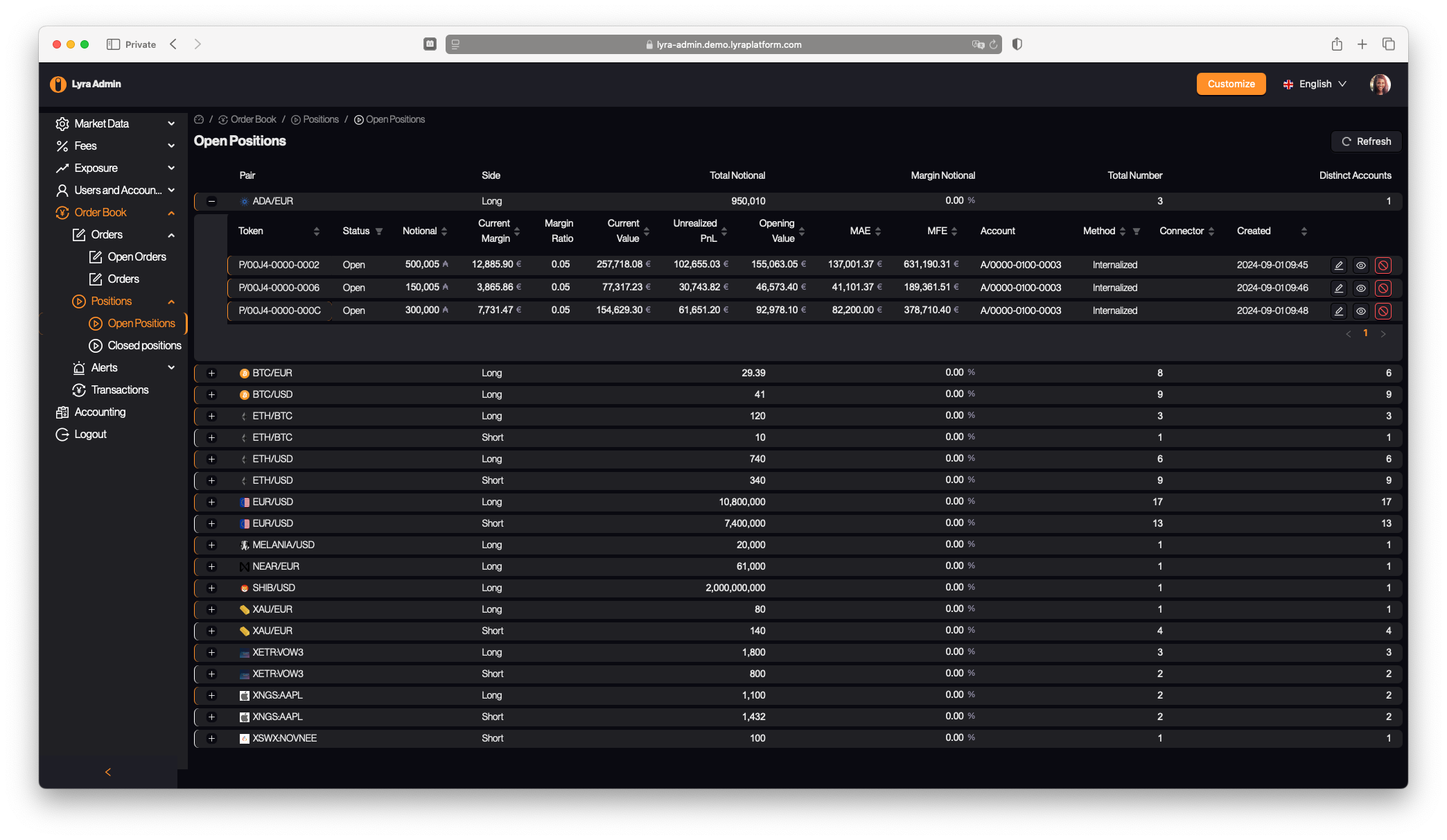

Live monitoring of pending orders, open positions, and margin accounts; real-time visibility into margin calls.

Every rule and override tie back to the same risk engine that powers trade-side analytics and routing.

Portal Highlights

Exposure dashboards, manual overrides, risk routing rules, margin enforcement, fee definition, and instrument logic—all in one place. The Lyra Operations Portal brings unified control to front- and middle-office functions, updated in real time and reflected instantly across the OMS and trading interface.

Supervisors and compliance teams can apply limits, override parameters, view historical data, and trigger real-time hedging. With deterministic behavior and deep audit visibility, the portal streamlines operations and keeps firmwide risk in check.

Instrument management

Open Positions

Operations Features at a Glance

Benefits

- Configure instruments, fees, routing, and risk rules—no redeployments, no delay.

- Monitor and act on firmwide risk trends with Basel-compliant metrics and advanced simulations.

- Monitor the live order book and intervene instantly—inspect, suspend, or close trader activity.

- Cut operational risk via deterministic margin policies and audit-proof overrides.

- Meet compliance demands faster with full logs, drop-copy feeds*, and tamper-evident trails.

Explore other key components of the Lyra platform: