Account control, identity management, and live client access—unified for compliance, support, and supervision.

Lyra's Account Management module combines secure data handling, live portfolio access, KYC tooling, and real-time communication—engineered for scale, security, and multi-role brokerage operations.

Compliance-Grade Access, Built for Scale

Lyra provides fine-grained role and data access separation for operations staff, supervisors, and external providers—built to handle both high-scale call centers and high-touch institutional support. Combined with secure data-at-rest encryption and live account drill-down, it offers operational flexibility without compromising client confidentiality.

Overview

Role-based access with layered permissions by client group, staff role, and visibility tier.

Encrypted sensitive fields with partial or blind confirmation modes for regulated data handling.

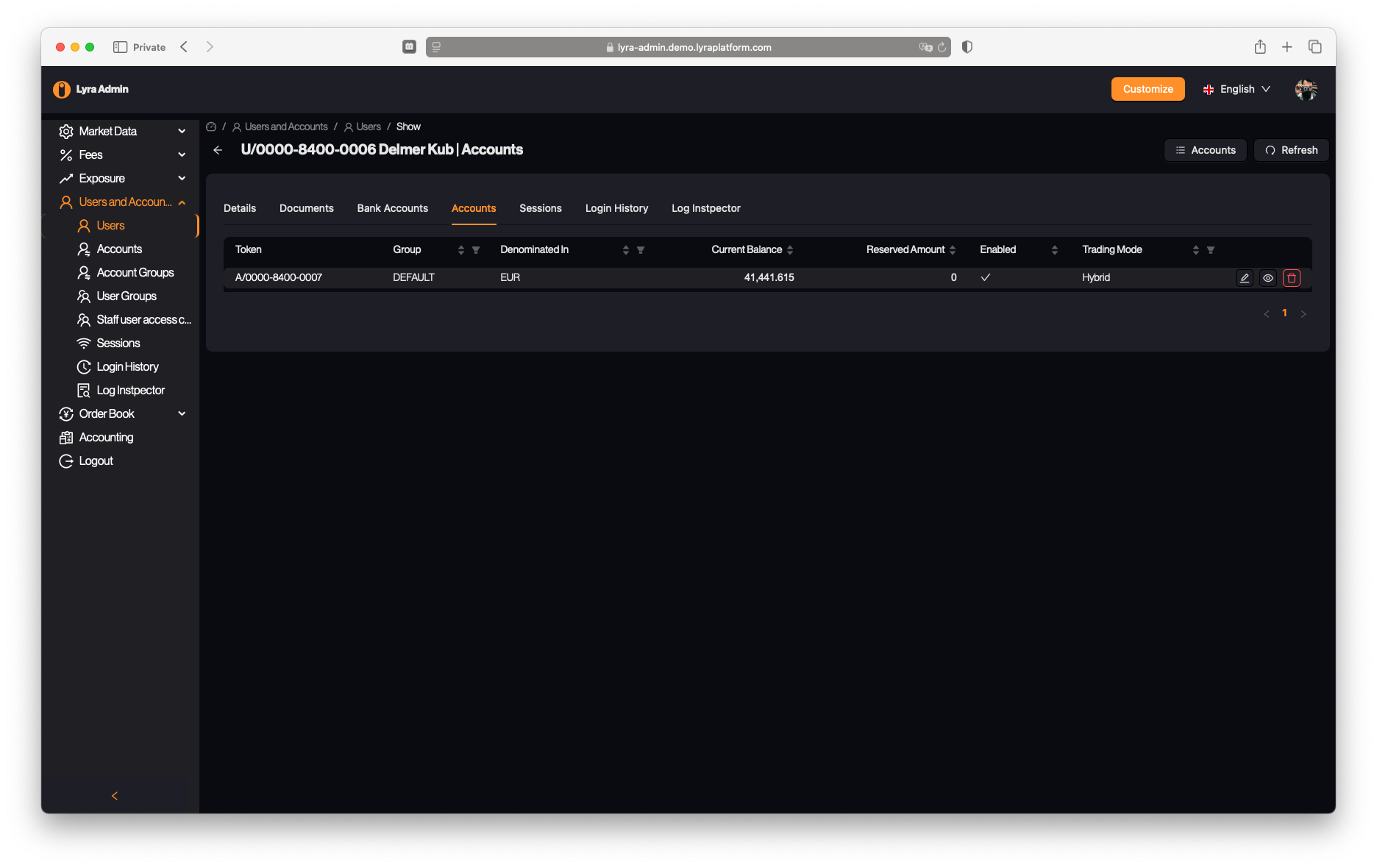

Live OMS Access: Monitor pending orders, active positions, and margin accounts in real time—based on permissions.

Self-service onboarding, KYC verification, and updates embedded into the trading UI.

User Management

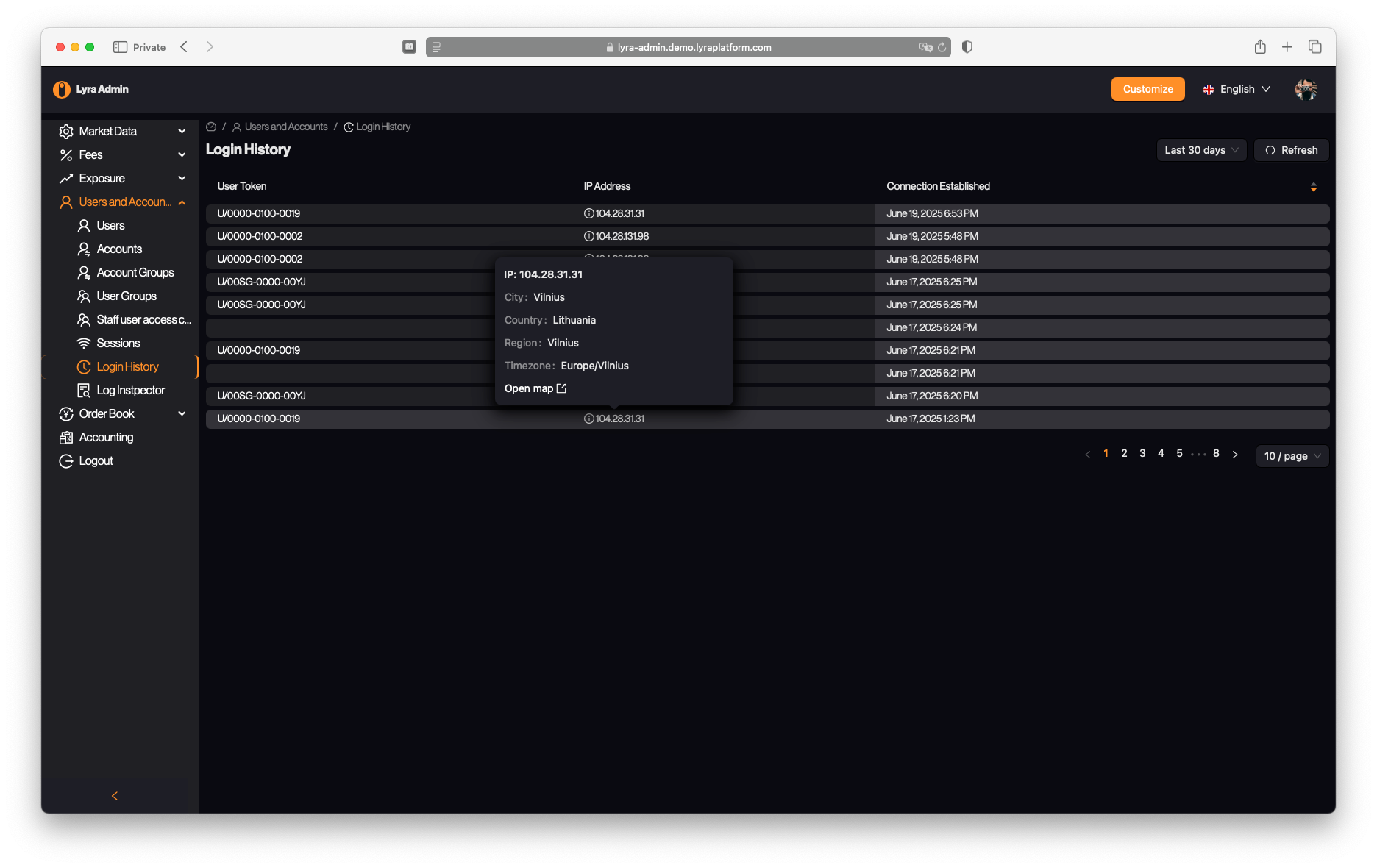

Login History

Account Management Features

Benefits

- Enforce strict permissions across support, compliance, and risk roles—no overlap, no blind spots.

- Handle regulated data safely with encrypted storage and audit-proof blind confirmation workflows.

- Access live OMS data to monitor and act on client positions, orders, and margin in real time.

- Track logins and active sessions with full audit trails, timestamps, IPs, and location data.

- Onboard, reverify, and segment clients with integrated KYC and role-driven access rules.

- Reduce overhead with self-service updates to KYC, credentials, and communication settings.

Explore other key components of the Lyra platform: